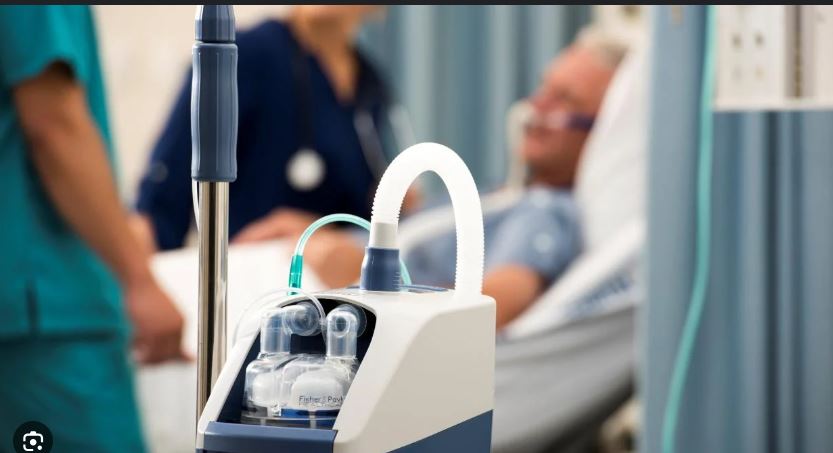

Fisher & Paykel Healthcare, the well-known New Zealand-based medical device manufacturer, is preparing for some financial turbulence thanks to new tariffs imposed by Donald Trump. The company, which produces gear used in

respiratory care, surgeries, and sleep apnea treatments, expects its costs to rise in the 2026 financial year as a result.

That said, they’re not too worried about immediate impacts—at least for now. They’ve reassured investors that the 2025 financial year profits should remain steady despite the tariffs.

Here’s the scoop: the U.S. government has announced a 25% tariff on goods from Mexico and Canada and a 10% tariff on imports from China, starting this week. This poses a bit of a headache for Fisher & Paykel since about 45% of their manufacturing happens in Mexico, with the other 55% taking place in New Zealand.

Given that the U.S. makes up around 43% of the company’s revenue, it’s a significant market for them. In fact, roughly 60% of the company’s products sold in the U.S. come from its Mexican facilities.

What’s Next for Costs?

The company has warned that tariffs could make things pricier in 2026, especially with the unpredictable global response to the U.S.’s trade moves and fluctuations in foreign currency. Still, Fisher & Paykel is confident they’ll stay on track to hit their gross margin target of 65%, though the tariffs might push that timeline back by a couple of years.

They’re currently sorting through the nitty-gritty details and will provide an update in May during their full-year financial report.

CEO’s Take

CEO Lewis Gordon remains optimistic, saying they’re in it for the long haul. The company plans to work with suppliers and U.S. customers to find ways around the tariff challenges.

“At the end of the day, our mission is about improving patient outcomes and reducing healthcare costs,” Gordon said. “We’ll keep finding ways to be efficient and manage these kinds of challenges.”

Trump’s Tariff Drama

The tariff news is part of Trump’s latest move to declare an economic emergency. Along with the tariffs on imports from Mexico, Canada, and China, energy imports from Canada—like oil and natural gas—will be hit with a 10% tax.

If these tariffs stick, inflation could get worse, shaking up the economy and raising concerns for voters who hoped for lower prices on essentials like groceries and gas.

Other countries aren’t taking this quietly either. Canada, led by Prime Minister Justin Trudeau, has already announced matching 25% tariffs on up to $155 billion worth of U.S. imports.

It looks like this tariff drama is just heating up..