The NZ property market is one of the most talked about topics right now. Open letters, debate, finger pointing, helpful suggestions – there is no shortage of any of these things. And the latest CoreLogic House Price Index (HPI) is likely to only add fuel to the fire. According to the CoreLogic HPI for November, nationwide property values accelerated further over the month, increasing 2.1%, after already lifting in both September and October. You must go all the way back to October 2004 (2.2%) to find a time of stronger monthly growth. The growth at the nationwide level is reflected throughout the country with each of the three sub-indices (Main Urban, Provincial and Rural) seeing accelerated rates of value growth through the last month.

So, the focus then turns to the Government and their concern that this economic recovery is worsening inequality. Anyone who owns assets like housing are benefitting from the stimulatory monetary policies, which are lowering interest rates, while the young and renting population are more likely to have seen their income impacted by the pandemic and are less likely to see a wealth benefit from asset appreciation.The CoreLogic affordability metrics illustrate this divide very well.

However, the metrics used to assess the ability to get into the market are all illustrating a worsening situation. The ratio of housing values compared to household income has jumped from 6.2 a year ago, to 6.8 at the end of Q3. Meanwhile the average time it takes to save for a 20% deposit in NZ is now 9.0 years, up from 8.2 years a year ago, and the share of income dedicated towards renting is increasing as well – up from 19.8% in Q3 2019 to 21.2% in the most recent reading.

The potential solutions to solve for the future are varied, and often complex. But they all need to be seriously considered. From the crucial supply perspective:

• Cheaper and faster off-site manufacturing needs to become more prevalent,

• Investment in infrastructure needs to increase to improve the connectivity and liveability throughout cities, especially the outer fringes where housing is more affordable but commuting times inefficient,

• Town planning reform needs to be addressed to incentivise appropriate intensification for best use – perhaps through taxes, and

• The cost to build must also be investigated, understood, and probably managed better.

And while addressing the demand side of the equation is more debatable, we need to consider how to reduce the property-owning obsession in NZ:

• Promote other forms of investment for retirement. Part of the greatest appeal of property is to provide a passive form of income in retirement (alongside expected capital gains),

• Improve security/appeal of renting – which should be a viable long-term living option. The Government has made some progress on this, and

• Favour investment in new builds above existing stock.

Main Centres

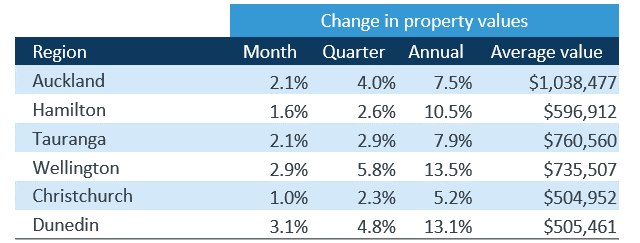

After a period of no growth following the COVID-19 enforced lockdown and subsequent uncertainty, the Dunedin market has roared back into action with 3.1% growth in the last month.

House Price Index – Main Centres Relative to December 2003

Wellington too remains one of the strongest growing markets of the main centres, with 2.9% growth over the month and 5.8% over the last three months.

Wellington City had a very strong month in November, with values growing 3.6% over the month to take the three-month growth rate to 5.6%. Over the three-month measure Porirua exceeded this rate though, with values growing 8.9% over the spring months.

Auckland too, is now firmly on the up again with 2.1% growth in November and a total of 4.0% growth since August.

And while there is still variability across the Super City, there is now no doubt all sections of the market are seeing a firm rebound. Indeed, the more expensive old Auckland City area, which previously lagged the more affordable areas, has one of the highest growth rates in the last three months of 4.3% (Waitakere saw a slightly larger 4.4% growth rate over the same period).

Meanwhile Christchurch continues to experience relatively modest growth as it has done for the last year with the annual growth rate hovering just above the 5% mark (5.2%) once again. Christchurch is sometimes referenced as a ‘well-functioning’ market, off the back of a significant lift in construction in response to the 2010/11 earthquakes and generally low growth. The increase in construction was assisted by changes made to the Resource Management Act (RMA) which streamlined the resource consenting process to enable homes to be built quicker so with a reform of the RMA something the current government has spoken about, Christchurch may prove a valuable case study.

Provincial Centres

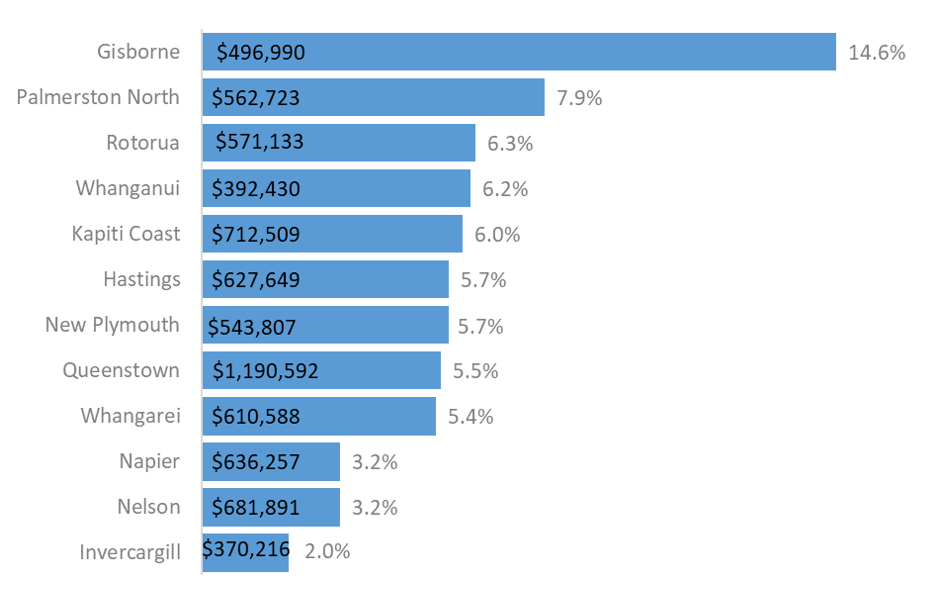

Queenstown is now firmly back on the up after a few months of diminishing values. 5.5% growth over the past three months have not quite reversed those losses, with values still -2.3% down on the peak prior to COVID.

All other provincial centres continued their strong growth from last month, especially Gisborne, where values are 14.6% higher now than they were in August. First home buyers have taken up a record share of sales so far in Q4, with 32% of sales to this group, no doubt helped by the availability of credit. There has also been strong investor appeal throughout 2020 in our easternmost city, with a regular share of 30% of sales going to mortgaged investors. With forestry and agriculture underpinning the local economy, Gisborne’s property market is thriving, as these industries are not as impacted by the COVID-19 pandemic.

Outlook

The RBNZ has announced it is likely to re-introduce the loan-to-value ratio (LVR) restrictions two months earlier than planned, however this is unlikely to curb value growth too much. The 70% LVR requirement for investors will take a section of buyers out who have recently been enjoying the relaxed settings, but while the lift in borrowing to this group increased significantly, their overall lending share remains small compared to the other groups.

Supply, by way of properties listed for sale, will remained constrained for the rest of the year. We have now passed the peak of new listings coming to market as people shift their mind to holidays, saving a decision like selling their house to the New Year. Given that first home buyers do not have anything to list and that investors aren’t generally selling before making their next purchase either, the fact that these are the most active buyer groups at present doesn’t bode well for listings either. Meanwhile demand for mortgages, as measured by valuations ordered through the banks, is remaining strong and this is unlikely to change throughout summer, aside from the usual holiday lull. So, expect values to remain pressured, and the Government likewise. (The above content, graphs and picture is courtesy www.corelogic.co.nz)

Index results as of November 30th, 2020

Three months change in dwelling values, Territorial Authorities, Main Urban Areas