BNZ forecasts 12% drop in house prices

BNZ’s economists, in the bank’s latest Economy Watch report titled New Zealand Construction Outlook, have predicted a decline in New Zealand house prices of around 12%, which the bank says is their “best pick currently”.

The report authors noted, “Residential construction, in particular, faces massive headwinds. Four factors will combine to conspire against future activity: – Lower population growth; – Heightened unemployment; – An increased supply of AirBnB properties becoming available; – Weaker house prices.”

“Lower population growth is likely to be the single biggest negative influence, and the rising unemployment rate is the biggest downside risk to both residential construction and house prices.”

The bank’s economists then add, “All of the above will likely result in a drop in house prices. A decline of around 12.0% is our best pick currently. Of course, the very fact that house prices are falling will put further downward pressure on the demand for new housing as already-nervous investors stay clear of the market.”

Taking some margin of error, the author in a final note said, “We concede we may be underestimating the extent of construction activity that both local and central government might fund so there could be upside risks to our forecasts. This is especially so with regard to spillover into the general construction sector from any significant increase in the government’s infrastructure programme. But, to the same extent, we are already seeing major projects cancelled and deferred so risks to the downside abound too.” – TIN Bureau

Highlights of the report

• Many think construction will pull NZ from recession

• We are less convinced

• Low population growth a major blow

• As is soaring unemployment

• Government will at least underwrite activity

Reserve Bank sees house prices falling 9% over this year

The Reserve Bank of New Zealand (RBNZ) of New Zealand while releasing its Monetary Policy Statement this week has elaborated on the impacts of COVID-19 on the New Zealand economy. “The COVID-19 outbreak and the measures taken to contain it have significantly reduced economic activity in New Zealand. Households and businesses face lower incomes and considerable uncertainty about the future. We estimate the level of real GDP to be about 22 percent lower in the June quarter of 2020.”

Significantly, the Bank noted, “With households facing lower wage growth, reduced hours, or unemployment, household spending is likely to decline. Over time, falling incomes associated with weak export receipts, slow wage growth, and reduced employment will continue to weigh on household spending, as will weak population growth due to low net immigration. Uncertainty around future employment and incomes will lead some households to reduce their spending in order to save money as a precaution.”

Finally, and something which will give house-owners looking to earn some capital gains from selling their homes quite a scare, the RBNZ added, “We expect lower population and household income growth to cause house prices to fall, despite lower construction activity, lower interest rates, and the easing of loan-to-value ratio restrictions. Our baseline scenario assumes house prices will fall by around 9 percent over the remainder of 2020.” – TIN Bureau

CoreLogic QV April 2020 House Price Index: Market momentum confirmed in the lead-up to COVID-19 lockdown, all eyes now turn to post-lockdown activity

According to the CoreLogic QV April 2020 House Price Index results out this week, momentum in the property market continued right up to the level four COVID-19 enforced lockdown. What’s less clear is how property values have performed through April. With sales activity stalling through the month, we won’t get a reliable measure on home prices until activity resumes under the more market friendly level 3 restrictions.

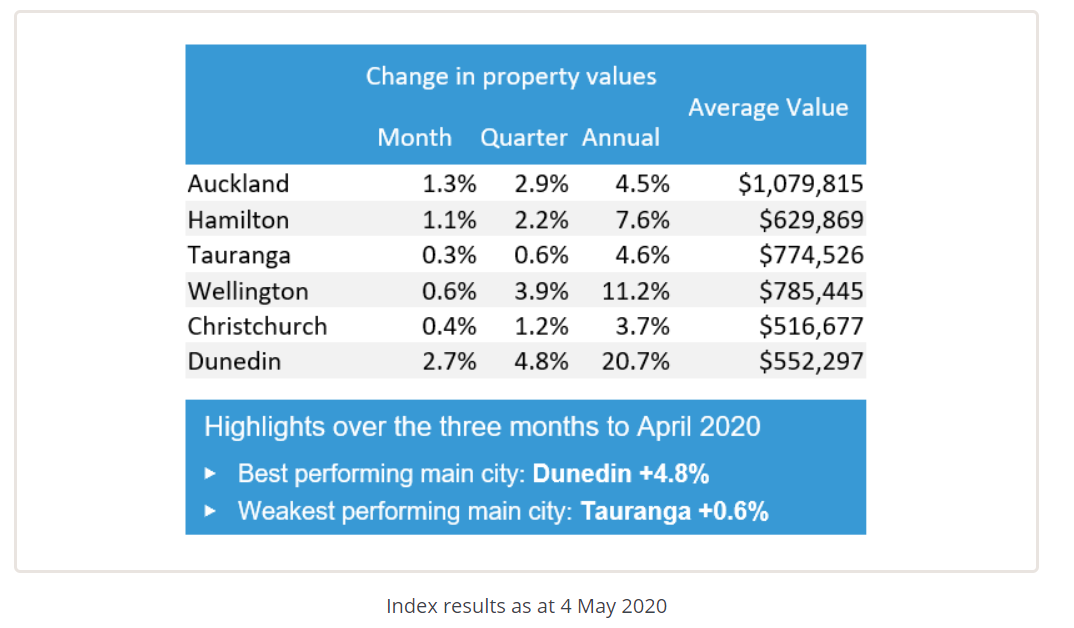

Technically, property values across NZ grew by 7.1% in the year to the end of April 2020 demonstrating strong market fundamentals prior to the COVID-19 disruption. For Auckland the annual growth rate was 4.5%, while Dunedin remained the main centre with the greatest momentum of 20.7% annual growth.

With the real estate market once again open for business, the focus now turns to the reaction from owners and would-be owners of property. Will there be a significant lift in listings as owners look to reduce their exposure in a weakening economy? And how will each of the regions perform, given the varied impact to different industries from shutting the economy down for almost 5 weeks?

Early signs of pre-listing activity for the property market are encouraging, with appraisals generated by agents more than doubling in the last week (albeit from a low base), but there will still be a small number of properties available for sale in the very short term. A lack of available supply had previously been a strong contributor to increasing property values around much of the country in the first quarter of 2020, and with very few new listings coming to market, choice will remain limited for those buyers still wanting to purchase.

While property listings are likely to be in short supply, demand for property will also be reduced due to a hangover in higher unemployment, lower household incomes, continued conservative bank policy and a significant dent to confidence. A large portion of prospective buyers are likely to hold off, or reconsider such a significant financial commitment in uncertain times.

A lack of both buyers and sellers could lead to a price stand-off as prospective buyers sense a re-balance of power in their favour, and consider the likelihood of price falls in the short term. Vendors will then be faced with the option of selling at a reduced price or holding on and hoping things improve.

(All information, picture and content in this section is courtesy www.corelogic.co.nz)