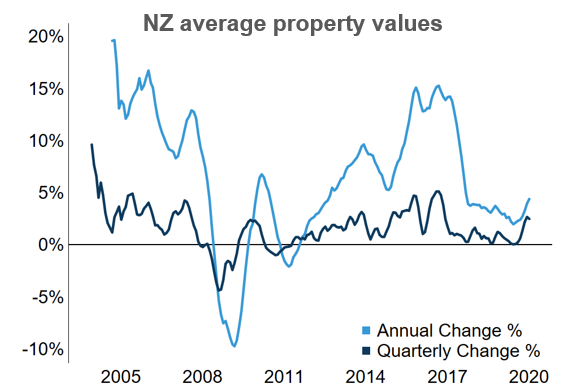

According to the CoreLogic QV January 2020 House Price Index, property values rose by 0.7% over the month, with the annual rate of growth increasing to 4.4%. That’s a further strengthening from the end of December 2019 which saw 4.0% growth over the year.

Property values strengthened in each of the six main centres as well as most of the main urban areas – particularly in those areas with lower average values. Indeed, property values in Gisborne grew by more than a quarter (25.7% or $83,000) over the last 12 months, to take the average property value over $400,000 for the first time. Property investors continue to see value in the market of our easternmost city, accounting for 38% of sales in the final quarter of 2019.

CoreLogic Head of Research, Nick Goodall said “The impact of low interest rates on housing affordability is too big to ignore. We measure affordability in four different ways; the median multiple (property value to income), the proportion of household income required to service a new mortgage, time to save a 20% deposit and rent to income ratio. Taking all these things into account you get a much better feel for affordability in an area.”

The Reserve Bank of NZ (RBNZ) remains another key influencer. Lending data released by the RBNZ last week provides further evidence of the strong end to the year in property. No doubt, all eyes will remain firmly on their releases on monetary policy and financial stability. The next date on the calendar is Wednesday 12 February, when the RBNZ reviews the Official Cash Rate (OCR) and with it their latest monetary policy statement.

There will be plenty for the RBNZ to consider, especially from a global perspective with Brexit now official and the coronavirus outbreak causing significant nervousness around the world. These factors, along with persistently low inflation and slowing economic growth will likely lead interest rates to remain low as economic growth and inflation continue to decline.

The recovery in property values across Auckland has continued. Although, as is often the case, the market wasn’t super strong in January itself – public holidays and extended summer breaks no doubt playing their part. Annual growth hit the positives though (0.3%) after remaining in the negatives for all of 2019. (All information and content in this section is courtesy www.corelogic.co.nz)